How To Read This Report

The NDC x SDG approach focuses on identifying the key interlinkages and pathways through which priority climate actions can accelerate a country’s most vital development goals. In doing so, it helps craft a clear, evidence-based narrative that brings together broad coalitions across government to drive coordinated progress.

The report is divided into four categories of analysis →

- NDC x SDG Moment — human progress within planetary boundaries is the next development frontier. This section provides a snapshot of key climate and human development data.

- NDC x SDG Alignment — maps climate commitments and national development priorities using custom machine learning tool that draws from an SDG vocabulary of 100k terms.

- NDC x SDG Interlinkages — identifies national-level actions through enhanced NDCs that accelerate SDG achievement and advances a robust development case.

- Finance & Stimulus — charts fiscal constraints and stimulus opportunities to ensure climate and development policy choices can be advanced with greatest impact.

1. NDC x SDG Moment

This section takes stock of the country’s current climate and sustainable development context, providing a clear snapshot of key climate and human development data and setting the scene to identify climate–development synergies.

As part of their mitigation measures, Uzbekistan has set a target of reducing emissions per unit of GDP by

35%

Sources European Commission 2023 (INFORM Climate Change Risk Index), IMF 2022 (IMF-Adapted ND-GAIN Index); Environmental Performance Index 2024 (GHG growth rate adjusted by emissions intensity & Projected Emissions in 2050); Helen Phillips; Adriana De Palma; Ricardo E Gonzalez; Sara Contu et al. 2021 (Biodiversity Intactness Index).

NDC x SDG Alignment

Goal Level

This analysis shows the most prominent SDGs in each of the two national strategies on climate and development. This identifies areas of common action and potential synergies across national climate and development priorities.

Nationally Determined Contributon (NDC)

Note: Based on Revised Nationally Determined Contribution (2021)

National Development Plan(s) (NDP)

Note: Based on National Development Plan 2023-2025 (2023)

These visuals are generated by analyzing the NDCs and National Development Plans through the SDG framework at goal level.

NDC x SDG Alignment

Target Level

This analysis shows how the country’s climate actions, both mitigation and adaptation, align with and drive impact across the SDGs at the target level.

Mitigation NDCs

Adaptation NDCs

These visuals are generated by analyzing NDC actions through a custom-built AI tool and categorized using the SCAN tool to surface relevant SDG synergies at the Goal level. For additional information on the NDC-SDG mapping, please visit: https://ambitiontoaction.net/scan_tool/

NDC x SDG Alignment

Action Level

This section breaks down the NDC categories into specific country commitments identified through a custom-built AI tool. The bubble sizes show how many actions fall under each category, helping pinpoint where NDC–SDG acceleration is most likely.

Uzbekistan 's NDC includes actions in these sectors:

Mitigation

Adaptation

3. NDC x SDG Interlinkages

NDC x SDG interlinkages reveal how climate actions can impact human development progress. Building from the country's NDC actions and SDG priorities, the following integrated SDG pathways reflect NDC actions with the most potential to accelerate the SDGs.

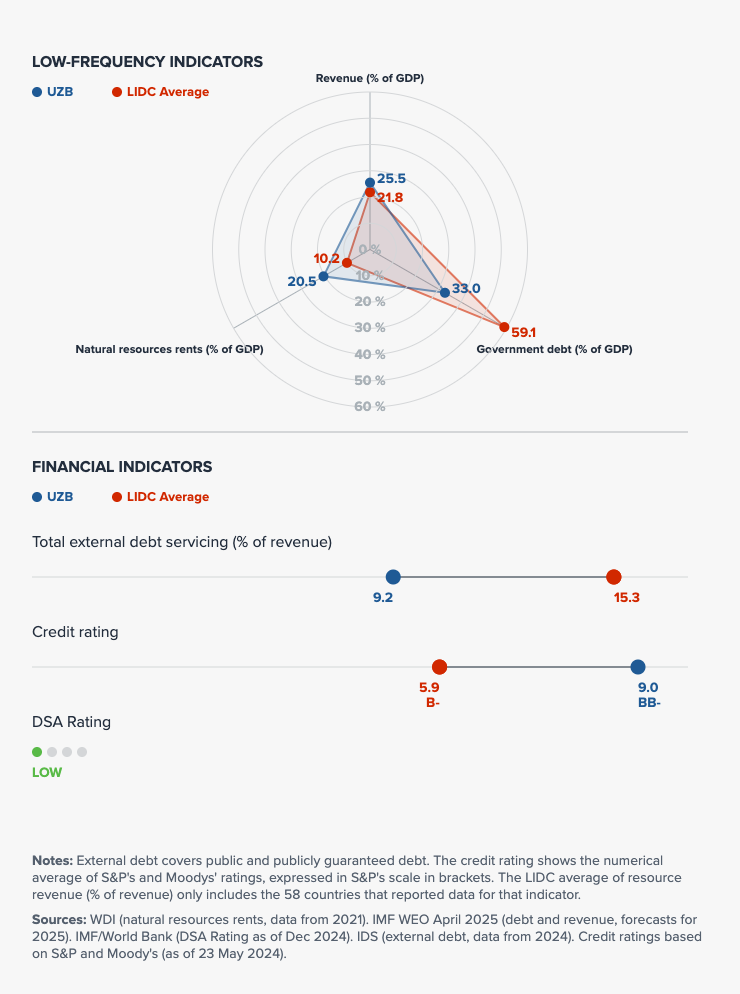

4. Finance & Stimulus

This section examines a country's fiscal space and public investment priorities, highlighting opportunities to align stimulus measures with SDG progress and accelerated climate action.

Many countries are facing reduced fiscal space, high debt levels, rising interest rates and downgrades on credit ratings. Fiscal and financial constraints tend to slow or even reverse SDG progress.

Public Finance

Financing needs

SDGs: Estimates from 2019 revealed Uzbekistan needs at least an additional, annual investment of USD 6.0 bn to meet the nationalized SDGs. (DFA 2021):

NDC: Total: Estimated 19,3 billion USD total by 2030

- 14.3 billion USD for mitigation

- 4.3 billion USD for adaptation

- 0.7 billion USD for capacity building actions

Financing strategy

Financing strategy for Uzbekistan 2030 under development

- Consideration of carbon tax and related climate fiscal policies

- Consolidated government revenue amounted to an equivalent of 28.6 percent of GDP, up from 24.9 percent of GDP in 2017

- In 2018-19, tax reforms lowered tax rates but maintained tax ratio of 28.6 percent of GDP in 2019 due to higher compliance and growth

Expenditures & budgets

- Since 2019 the Government of Uzbekistan performs the SDG budget Tagging exercise using a basic model and regularly presents the results in the publications of a Citizen’s Budget.

- According to the tagging results during the last few years in average around 70% of the state budget expenditures in Uzbekistan were allocated and aligned with SDGs.

- Add expenditure bullet 3 here...

Debt instruments

- In July 2021, the Government of Uzbekistan issued a first sovereign SDG Bonds in the region (UZS denominated, USD Equiv. 235 Million)

- In October 2023, the Government of Uzbekistan issued a debut sovereign Green Bonds (UZS denominated, USD Equiv. 350 Million)

- In May 2024, the Government of Uzbekistan issued SDG Bonds (USD Equiv. 650 Million).

International climate finance

- 55 million in total GEF funding for climate (GEF, 2024)

- 60 million in total GCF funding (GCF, 2024)

- 16.5 million in total Adaptation Fund funding (Adaptation Fund, 2024)

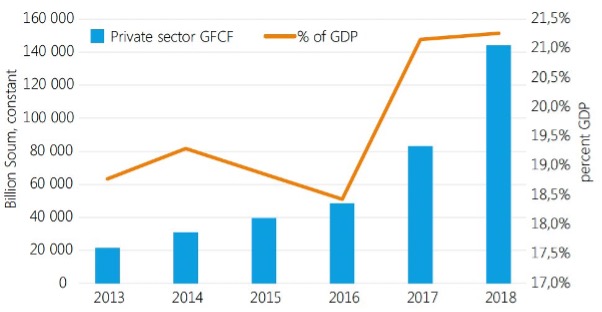

Private Finance & Economy

Policy & Regulatory Measures:

Innovative Instruments:

Sustainability Taxonomies / ESG

SDG Bond Framework, providing a comprehensive tool to maintain coherence across performance monitoring criteria and indicators

SDG and Green sovereign bond issuances

Derisking & Inclusive Finance

Green Economy Financing Facility (GEFF), EUR 4.4 million EBRD credit line for on-lending to private companies

International Investment:

Initiatives launched under the Integrated National Financing Framework (INFF) to catalyze foreign investment in sustainable development, leveraging innovative financing mechanisms for sustainable and inclusive economic growth 3.1% Foreign direct investment, net inflows (of GDP) (2022)

Domestic Investment:

Unlocking domestic private finance through financing reforms, fostering an environment conducive to domestic investments in green technologies and sustainable infrastructure