How To Read This Report

The NDC x SDG approach focuses on identifying the key interlinkages and pathways through which priority climate actions can accelerate a country’s most vital development goals. In doing so, it helps craft a clear, evidence-based narrative that brings together broad coalitions across government to drive coordinated progress.

The report is divided into four categories of analysis →

- NDC x SDG Moment — human progress within planetary boundaries is the next development frontier. This section provides a snapshot of key climate and human development data.

- NDC x SDG Alignment — maps climate commitments and national development priorities using custom machine learning tool that draws from an SDG vocabulary of 100k terms.

- NDC x SDG Interlinkages — identifies national-level actions through enhanced NDCs that accelerate SDG achievement and advances a robust development case.

- Finance & Stimulus — charts fiscal constraints and stimulus opportunities to ensure climate and development policy choices can be advanced with greatest impact.

1. NDC x SDG Moment

This section takes stock of the country’s current climate and sustainable development context, providing a clear snapshot of key climate and human development data and setting the scene to identify climate–development synergies.

As part of their mitigation policies and measures (PAMs), the Philippines has set a target of reducing emissions by

990 MtCO2e

(37%)

Sources European Commission 2023 (INFORM Climate Change Risk Index), IMF 2022 (IMF-Adapted ND-GAIN Index); Environmental Performance Index 2024 (GHG growth rate adjusted by emissions intensity & Projected Emissions in 2050); Helen Phillips; Adriana De Palma; Ricardo E Gonzalez; Sara Contu et al. 2021 (Biodiversity Intactness Index).

NDC x SDG Alignment

Goal Level

This analysis shows the most prominent SDGs in each of the two national strategies on climate and development. This identifies areas of common action and potential synergies across national climate and development priorities.

Nationally Determined Contributon (NDC)

Note: Based on NDC (2021) and NDC Implementation Plan 2020-2030 (2023)

National Development Plan(s) (NDP)

Note: Based on Philippine Development Plan (2023-2028)

These visuals are generated by analyzing the NDCs and National Development Plans through the SDG framework at goal level.

NDC x SDG Alignment

Target Level

This analysis shows how the country’s climate actions, both mitigation and adaptation, align with and drive impact across the SDGs at the target level.

Mitigation NDCs

Adaptation NDCs

These visuals are generated by analyzing NDC actions through a custom-built AI tool and categorized using the SCAN tool to surface relevant SDG synergies at the Goal level. For additional information on the NDC-SDG mapping, please visit: https://ambitiontoaction.net/scan_tool/

NDC x SDG Alignment

Action Level

This section breaks down the NDC categories into specific country commitments identified through a custom-built AI tool. The bubble sizes show how many actions fall under each category, helping pinpoint where NDC–SDG acceleration is most likely.

Philippines 's NDC includes actions in these sectors:

Mitigation

Adaptation

3. NDC x SDG Interlinkages

NDC x SDG interlinkages reveal how climate actions can impact human development progress. Building from the country's NDC actions and SDG priorities, the following integrated SDG pathways reflect NDC actions with the most potential to accelerate the SDGs.

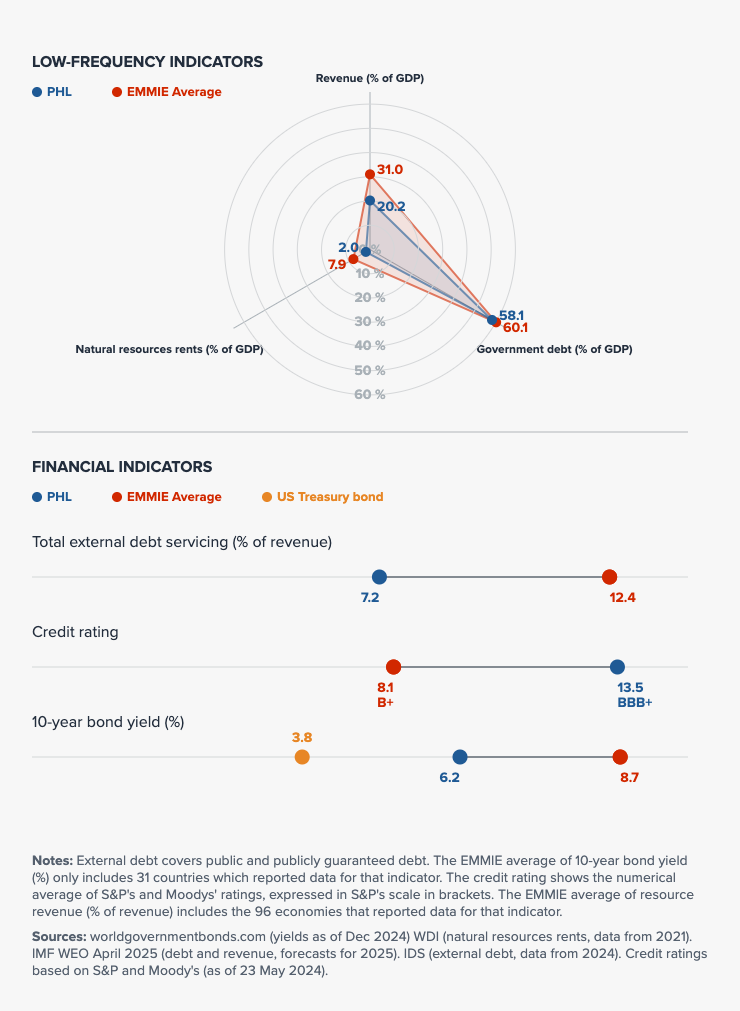

4. Finance & Stimulus

This section examines a country's fiscal space and public investment priorities, highlighting opportunities to align stimulus measures with SDG progress and accelerated climate action.

Many countries are facing reduced fiscal space, high debt levels, rising interest rates and downgrades on credit ratings. Fiscal and financial constraints tend to slow or even reverse SDG progress.

Public Finance

Financing needs

- Close fiscal gap from high debt and low revenue.

- Fund climate resilience and infrastructure.

- Mobilize private investment for green projects.

Financing strategy

- Sovereign green bonds for international capital.

- Policy incentives to attract private finance.

- Dedicated funds like the People’s Survival Fund.

Expenditures & budgets

- In 2025, Climate change expenditures totalling Php 1.020 trillion will support the strategic priorities of the National Climate Change Action Plan.

- Similarly, the government is allocating Php 2.9 billion in 2025 to preserve Philippine forests through reforestation and sustainable management of protected areas.

- The government is allocating Php 293 billion to strengthen disaster resilience through flood management infrastructure, disaster risk reduction, and rapid response funds.

Debt instruments

- Sovereign Green Bonds: Issued under the Sustainable Finance Framework to raise international capital (e.g., ~USD 3.55 billion total, including bonds in the Japanese Samurai market).

- Concessional Loans: Provided by government financial institutions for green projects, as mandated by laws like the Renewable Energy Act.

International climate finance

- International resource mobilization based on the Sustainable Finance Framework

- By October 2023, this framework has subsequently facilitated the successful execution of four sovereign transactions, mobilizing a total of approximately USD 3.55 billion in international capital. A significant component of this includes a JPY 70.1 billion (USD 550 million equivalent) bond issuance in the Japanese Samurai market.

Private Finance & Economy

Policy & Regulatory Measures:

Innovative Instruments:

- Green bond issued in 2023 by Bank of the Philippine Island (BPI) to raise capital for financing green assets, with a USD 250 million buy-in by the IFC (IFC. 2023)

- Third offering in 2025 of a sustainability bond by BDO Unibank , raising USD 947 million (Business World, 2024)

- The Philippines has also participated in the issuance of a new sovereign catastrophe-linked bond (“CAT-bond”), arranged through the World Bank, which is structured to provide up to US$225 million in coverage over a three-year period (World Bank, 2020).

International Investment:

- UAE's State energy firm Masdar carried out a USD 15 billion investment in 2025 to develop solar, wind and battery energy storage systems, providing it with up to 1 gigawatt of clean power by 2030. (Department of Energy, 2025).

- Copenhagen Infrastructure Partners will invest USD 3 billion to build its first offshore wind farm in Camarines Sur. (PowerPhilippines.2025)

Domestic Investment:

- BDO Unibank financing the world’s largest integrated solar and battery storage project, MTerra Solar (USD 2.5 billion) in Nueva Ecija. (BDO,2025)

SDG Investor Map

12 Investment Opportunity Areas (IOAs) that contribute to the government’s NDC priorities and meet SDG needs. The priority IOAs span 7 climate adaptation-relevant sectors in the Philippines:

Development Breakthrough

Policy Brief

Each NDC x SDG Insights policy brief is a focused, country-specific deep dive that builds on the broader Insights report to unpack a single development breakthrough, outlining its policy implications and the SDG-positive actions driving it forward.