How To Read This Report

The NDC x SDG approach focuses on identifying the key interlinkages and pathways through which priority climate actions can accelerate a country’s most vital development goals. In doing so, it helps craft a clear, evidence-based narrative that brings together broad coalitions across government to drive coordinated progress.

The report is divided into four categories of analysis →

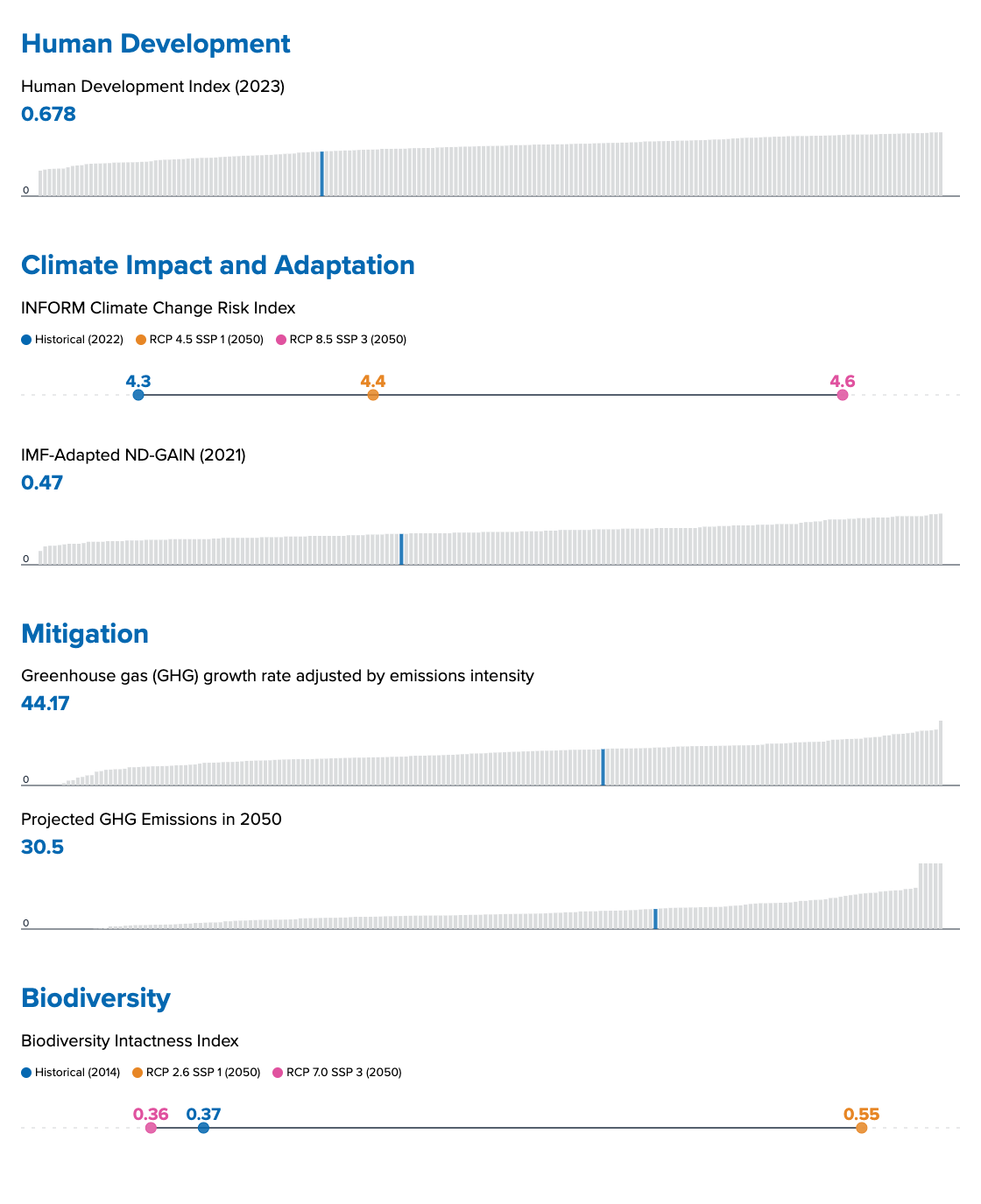

- NDC x SDG Moment — human progress within planetary boundaries is the next development frontier. This section provides a snapshot of key climate and human development data.

- NDC x SDG Alignment — maps climate commitments and national development priorities using custom machine learning tool that draws from an SDG vocabulary of 100k terms.

- NDC x SDG Interlinkages — identifies national-level actions through enhanced NDCs that accelerate SDG achievement and advances a robust development case.

- Finance & Stimulus — charts fiscal constraints and stimulus opportunities to ensure climate and development policy choices can be advanced with greatest impact.

1. NDC x SDG Moment

This section takes stock of the country’s current climate and sustainable development context, providing a clear snapshot of key climate and human development data and setting the scene to identify climate–development synergies.

As part of their mitigation measures, El Salvador has set a target of reducing emissions of up to

819 KtCO₂e

Sources European Commission 2023 (INFORM Climate Change Risk Index), IMF 2022 (IMF-Adapted ND-GAIN Index); Environmental Performance Index 2024 (GHG growth rate adjusted by emissions intensity & Projected Emissions in 2050); Helen Phillips; Adriana De Palma; Ricardo E Gonzalez; Sara Contu et al. 2021 (Biodiversity Intactness Index).

NDC x SDG Alignment

Goal Level

This analysis shows the most prominent SDGs in each of the two national strategies on climate and development. This identifies areas of common action and potential synergies across national climate and development priorities.

Nationally Determined Contributon (NDC)

Note: Based on Revised Nationally Determined Contribution (2021)

National Development Plan(s) (NDP)

Note: Based on National Development Plan 2023-2025 (2023)

These visuals are generated by analyzing the NDCs and National Development Plans through the SDG framework at goal level.

NDC x SDG Alignment

Target Level

This analysis shows how the country’s climate actions, both mitigation and adaptation, align with and drive impact across the SDGs at the target level.

Mitigation NDCs

Adaptation NDCs

These visuals are generated by analyzing NDC actions through a custom-built AI tool and categorized using the SCAN tool to surface relevant SDG synergies at the Goal level. For additional information on the NDC-SDG mapping, please visit: https://ambitiontoaction.net/scan_tool/

NDC x SDG Alignment

Action Level

This section breaks down the NDC categories into specific country commitments identified through a custom-built AI tool. The bubble sizes show how many actions fall under each category, helping pinpoint where NDC–SDG acceleration is most likely.

El Salvador 's NDC includes actions in these sectors:

Mitigation

Adaptation

3. NDC x SDG Interlinkages

NDC x SDG interlinkages reveal how climate actions can impact human development progress. Building from the country's NDC actions and SDG priorities, the following integrated SDG pathways reflect NDC actions with the most potential to accelerate the SDGs.

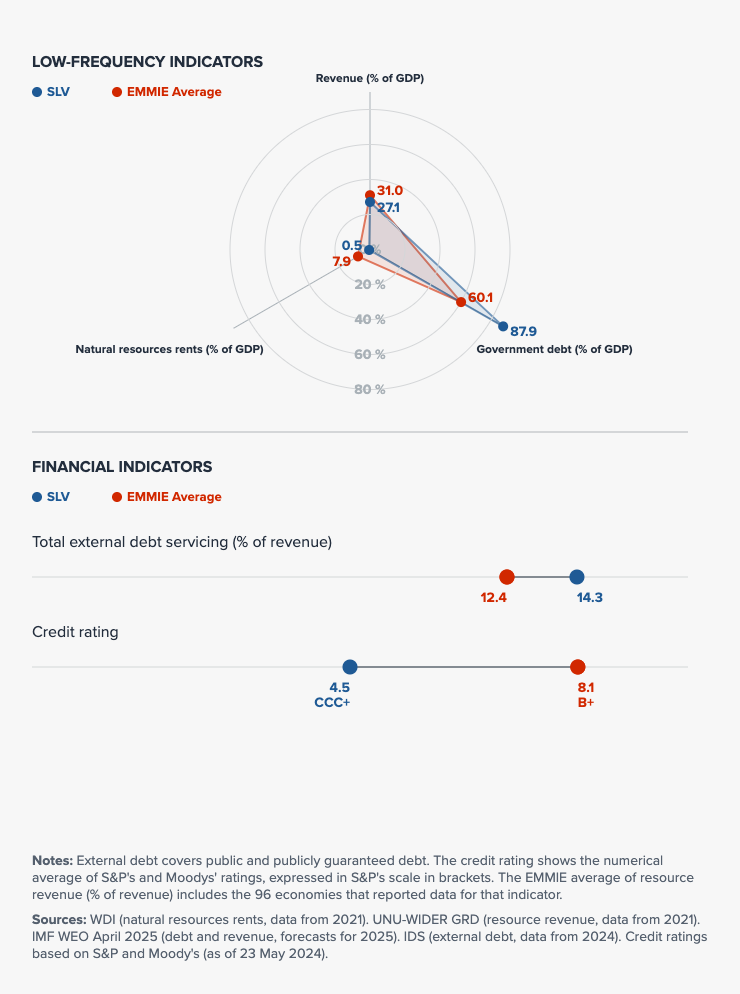

4. Finance & Stimulus

This section examines a country's fiscal space and public investment priorities, highlighting opportunities to align stimulus measures with SDG progress and accelerated climate action.

Public finances are constrained by public debt. The non-financial public sector debt balance, excluding pensions, was 57.3% of GDP in September 2024, and grew 4.4% compared to the end of 2023. The pension debt balance is approximately 29.2% of GDP. The country risk, measured by the emerging market bond index, was 4.2 points on December 4th, 2024.

Public Finance

Financing needs

NDC: Total: Estimated $1.05 billion USD total by 2030

- Mitigation: $712.1m

- Adaptation: $333.9m

- Integrated Climate Strategies: $4.96m

Financing strategy

Financing Strategy: Double Dividend Climate Financing

- El Salvador's climate financing strategy is centered on the Double Dividend Climate Financing approach, which aims to achieve both economic growth and environmental sustainability. This strategy focuses on mobilizing resources through innovative instruments, such as green bonds, blended finance, and public-private partnerships, to:

- Enhance Economic Development: Invest in renewable energy, sustainable agriculture, and low-carbon infrastructure to create jobs, stimulate local economies, and improve livelihoods.

- Achieve Climate Goals: Direct funding towards mitigation and adaptation projects that reduce emissions, enhance resilience, and safeguard ecosystems in alignment with NDC targets

Expenditures & budgets

The Ministry of Finance, supported by UNDP, is implementing the Climate Budget Tagging methodology to align national budgets with climate objectives, and Biodiversity Finance Initiative (BIOFIN): Supports identifying and mobilizing resources for biodiversity conservation.

Debt instruments

In 2024, El Salvador completed the largest debt-for-nature swap, with over $1bn , including $350m allocated to the Lempa River watershed restoration

The first social bond in El Salvador is issued with IDB Invest and Fedecrédito, totaling $80m. An initial $40m tranche includes $20m subscribed by IDB Invest, with co-investors covering the remainder.

International climate finance

El Salvador has benefited from GEF funding to support projects in biodiversity, climate change mitigation, and adaptation. Total GEF financing is $9.6m, with $8m explicitly dedicated to climate change.

The country accesses GCF resources for projects in renewable energy, sustainable agriculture, and water management. Total GCF financing is $112.8 million.

Sources: BIOFIN (Accessed Dec 2024); Reuters (2024); IDB Invest (2024); GEF (Accessed 2024); GCF (Accessed 2024)

Private Finance & Economy

Policy & Regulatory Measures:

Sources Green Finance for Latin America and the Caribbean (Accessed Dec 2024); AES El Salvador Sustainability Report 2023; UNSDG, Unlocking the data dividend for the SDGs in El Salvador (2024).

Innovative Instruments:

La Cuenta del Mar (Banco Agrícola). Protects mangroves through a partnership with Mastercard and Fundación Doménech.

FIAES Environmental Fund: FIAES mobilizes resources to finance conservation and sustainable agriculture projects, mitigating risks for private sector investments while fostering community resilience.

Energy Efficiency Financing Facility (The Development Bank of El Salvador, BANDESAL), Provides concessional loans, technical validation, and energy savings insurance for Small and Medium-sized Enterprises. Supported by IDB and the Green Climate Fund.

International Investment:

El Salvador participates in global programs such as EUROCLIMA (€1.1 million), the Green Climate Fund (GCF, $57.5 million), and the Global Environment Facility (GEF, $5.13 million), securing a total of approximately $63 million for renewable energy, sustainable agriculture, and climate resilience initiatives.

Domestic Investment:

The significant improvement in security has had a positive impact on the business climate and private investment.

SDG Investor Map

El Salvador presents 11 Investment Opportunity Areas (IOAs) aligned with its NDC priorities and SDGs. Key sectors include:

- Renewable Energy, focusing on solar, wind, and geothermal projects (SDGs 7, 13)

- Sustainable Agriculture, promoting climate-resilient farming and agroforestry (SDGs 2, 12, 15).

- Green Urban Infrastructure investments target low-emission buildings, sustainable public transport, and efficient waste management (SDGs 9, 11, 13).

- Circular Economy emphasizes recycling facilities and reduced plastic pollution (SDGs 6, 12, 14).

- Innovative Financial Instruments like green bonds and public-private partnerships mobilize resources for climate action (SDG 17).

Development Breakthrough

Policy Brief

Each NDC x SDG Insights policy brief is a focused, country-specific deep dive that builds on the broader Insights report to unpack a single development breakthrough, outlining its policy implications and the SDG-positive actions driving it forward.