How To Read This Report

The NDC x SDG approach focuses on identifying the key interlinkages and pathways through which priority climate actions can accelerate a country’s most vital development goals. In doing so, it helps craft a clear, evidence-based narrative that brings together broad coalitions across government to drive coordinated progress.

The report is divided into four categories of analysis →

- NDC x SDG Moment — human progress within planetary boundaries is the next development frontier. This section provides a snapshot of key climate and human development data.

- NDC x SDG Alignment — maps climate commitments and national development priorities using custom machine learning tool that draws from an SDG vocabulary of 100k terms.

- NDC x SDG Interlinkages — identifies national-level actions through enhanced NDCs that accelerate SDG achievement and advances a robust development case.

- Finance & Stimulus — charts fiscal constraints and stimulus opportunities to ensure climate and development policy choices can be advanced with greatest impact.

1. NDC x SDG Moment

This section takes stock of the country’s current climate and sustainable development context, providing a clear snapshot of key climate and human development data and setting the scene to identify climate–development synergies.

As part of their NDC Guatemala has set a target of reducing emissions by

11.2%

Sources European Commission 2023 (INFORM Climate Change Risk Index), IMF 2022 (IMF-Adapted ND-GAIN Index); Environmental Performance Index 2024 (GHG growth rate adjusted by emissions intensity & Projected Emissions in 2050); Helen Phillips; Adriana De Palma; Ricardo E Gonzalez; Sara Contu et al. 2021 (Biodiversity Intactness Index).

NDC x SDG Alignment

Goal Level

This analysis shows the most prominent SDGs in each of the two national strategies on climate and development. This identifies areas of common action and potential synergies across national climate and development priorities.

Nationally Determined Contributon (NDC)

Note: Based on Updated Nationally Determined Contribution (2022)

National Development Plan(s) (NDP)

Note: Based on National Development Plan K’atun Our Guatemala 2032

These visuals are generated by analyzing the NDCs and National Development Plans through the SDG framework at goal level.

NDC x SDG Alignment

Target Level

This analysis shows how the country’s climate actions, both mitigation and adaptation, align with and drive impact across the SDGs at the target level.

Mitigation NDCs

Adaptation NDCs

These visuals are generated by analyzing NDC actions through a custom-built AI tool and categorized using the SCAN tool to surface relevant SDG synergies at the Goal level. For additional information on the NDC-SDG mapping, please visit: https://ambitiontoaction.net/scan_tool/

NDC x SDG Alignment

Action Level

This section breaks down the NDC categories into specific country commitments identified through a custom-built AI tool. The bubble sizes show how many actions fall under each category, helping pinpoint where NDC–SDG acceleration is most likely.

Guatemala 's NDC includes actions in these sectors:

Mitigation

Adaptation

3. NDC x SDG Interlinkages

NDC x SDG interlinkages reveal how climate actions can impact human development progress. Building from the country's NDC actions and SDG priorities, the following integrated SDG pathways reflect NDC actions with the most potential to accelerate the SDGs.

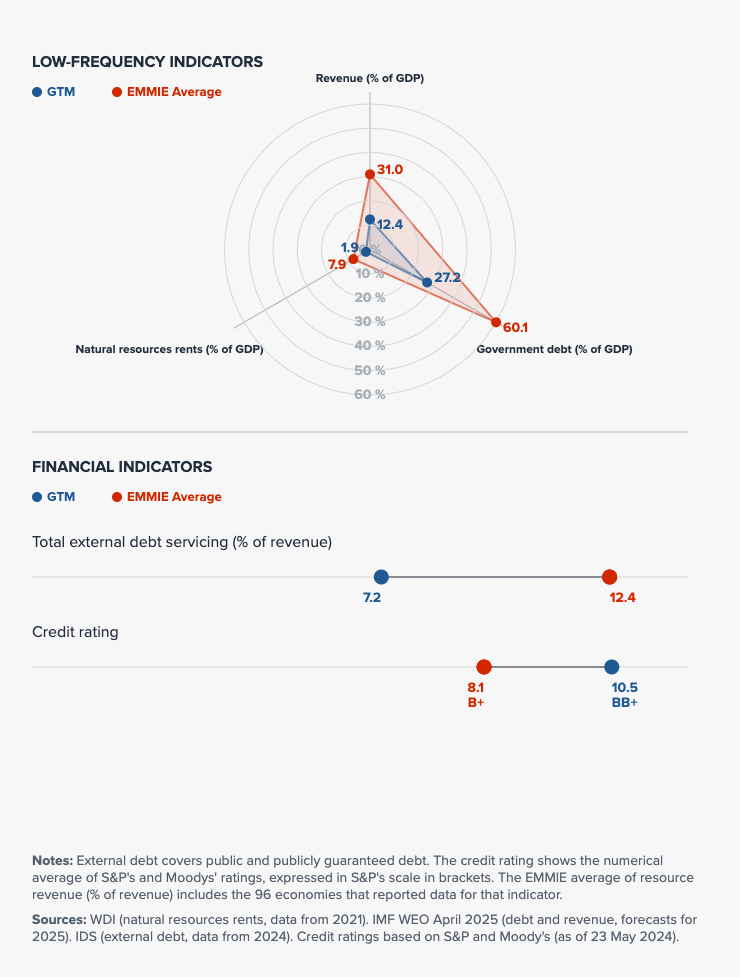

4. Finance & Stimulus

This section examines a country's fiscal space and public investment priorities, highlighting opportunities to align stimulus measures with SDG progress and accelerated climate action.

Many countries are facing reduced fiscal space, high debt levels, rising interest rates and downgrades on credit ratings. Fiscal and financial constraints tend to slow or even reverse SDG progress.

Public Finance

Financing needs

SDGs: Over 8.6 billion USD per annum in capital investment required to reach growth targets necessary for achieving SDGs (DFA 2021)

NDC: Total: Estimated 29.6 billion USD total by 2030

- 8.6 billion USD for mitigation

- 21 billion USD for adaptation

Financing strategy

Guatemala’s climate financing strategy combines the Sustainable Financing Framework (MINFIN, 2024) to issue bonds with the Environmental Fiscal Strategy guiding fiscal policy. The Climate Change Framework Law (Decree 7-2013) created the National Climate Change Fund (FONCC), regulated in 2022, to finance mitigation, adaptation and risk management. In 2024 the government issued sustainability notes aligned to the framework. Together, these instruments mobilize capital and ensure governance, transparency, and reporting of outcomes.

Expenditures & budgets

In 2013 the Fondo Nacional de Cambio Climático was created and regulated by Governmental Agreement 109-2022. Its objective is to finance plans, programs, and projects for risk management, vulnerability reduction, adaptation and mitigation, and capacity building. In 2025 it received an allocation of US$6.53 million.

Debt instruments

Guatemala issued a US$800 million sustainable sovereign bond in 2024, maturing 2037, under its Sustainable Financing Framework, allocating proceeds to climate mitigation, adaptation, and social objectives, with clear reporting commitments.

International climate finance

- GCF: Over 113.2 million total to date

- GEF: Approx. 47 million total for climate change to date

- CIF: Approx. 15.4 million total to date

- World Bank: 430 million total to date

- Germany: 11.6 million in debt swap

Private Finance & Economy

Policy & Regulatory Measures:

Innovative Instruments:

- Green bond to finance a renewable energy portfolio (mitigation).

- Sustainable bond program.

- Banco Promerica Guatemala — Sustainability-linked bond, 30-May-2024: bond with performance-linked incentives to fund green/social projects.

- BVN (Bolsa de Valores Nacional) — Market rule, Mar-2022: internal normative enabling green/social/sustainable and sustainability-linked labels for private bonds.

International Investment:

- CMI Energía — Green bond (Rule 144A/Reg S), 2021: US$700M to finance a renewable energy portfolio (mitigation).

- BAC Guatemala — Sustainable bond program, 2023–2024: up to US$140M (initial US$70M) to expand green/social lending.

Domestic Investment:

The chart shows Guatemala’s private investment as a share of GDP falling from about 17–18% in the early 2000s to roughly 16% by 2008, then dropping sharply near 13% around 2009. Through the 2010s it hovers in a lower band (≈12.5–13.5%), slipping to a trough near 12% by 2018–2019. Beginning in 2020–2021, the ratio rebounds rising above 14.5% in 2022 and reaching a little over 15% in 2024. Overall, the series depicts a long decline after 2008 followed by a notable post-2020 recovery.

Development Breakthrough

Policy Brief

Each NDC x SDG Insights policy brief is a focused, country-specific deep dive that builds on the broader Insights report to unpack a single development breakthrough, outlining its policy implications and the SDG-positive actions driving it forward.